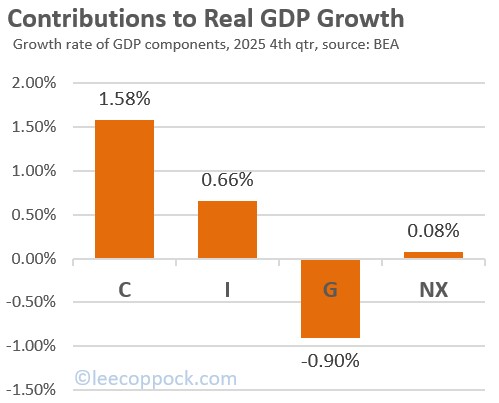

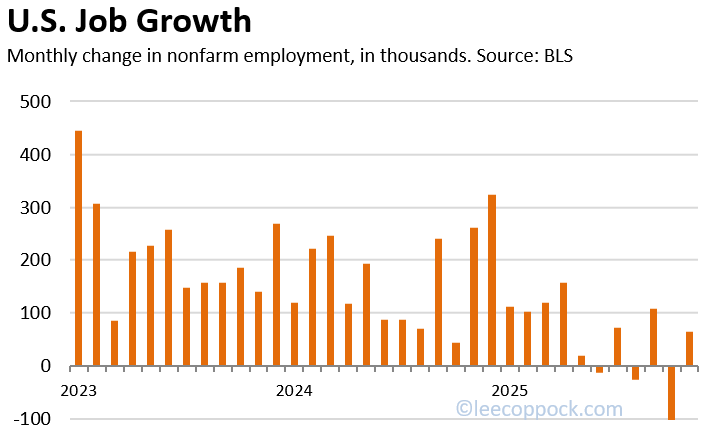

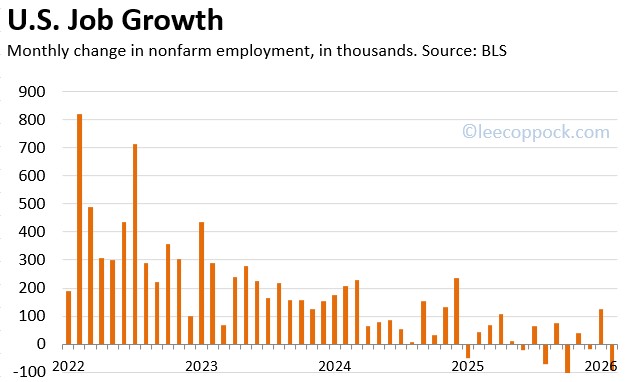

The Bureau of Labor Statistics (BLS) dropped their monthly jobs report this morning and the employment data is not great, Bob. The unemployment rate ticked up slightly to 4.4 percent. But most concerning is the big decline in total jobs. Nonfarm employment fell by 92,000 jobs in February. This combined with downward revisions to earlier estimates, means that the U.S. economy has not added any jobs (on net) since April 2025. Incredible.

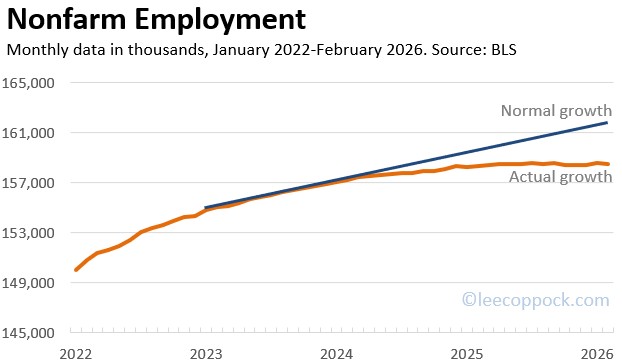

The graphic below shows monthly growth in Nonfarm Employment since the beginning of 2022. A normal month of U.S. jobs growth would net about 200,000 jobs. You can see that jobs growth slowed considerably since March 2024.

In fact, since last April, the U.S. economy is actually down about 2 million jobs from a normal rate of growth since last April. The figure below shows total nonfarm employment versus a normal growth trend of about 200,000 jobs per month – with a gap of about 2 million jobs.

What is causing this dearth of jobs? It is probably a combination of tariffs and AI. On the tariffs front, it is probably not coincidental that President Trump’s “Liberation Day” was April 2, 2025, just about the time the economy stopped adding jobs altogether. While tariffs MAY lead to more manufacturing jobs in the long run, the uncertainty and transition period have left many employers reluctant to expand just yet. And while AI will likely have positive growth effects in the long run, there will certainly be some structural unemployment introduced in the short run.

Finally, many students will wonder why the unemployment rate is still fairly low. Part of this is the decline in the labor force participation rate, which is now down to just 62.0 percent, from 62.7 percent just two years ago. So workers are leaving the labor force and this keeps the unemployment rate relatively low. Note that it has actually climbed from lows of 3.4 percent in 2023.

Here is your takeaway:

- Jobs growth in February was negative 92,000.

- This contiunes a trend which has led to zero net jobs since April of last year.

- The unemployment rate rose just slightly and is kept low because of declines in LFPR.

- The likely culprits are AI and tariffs.

Let’s hope we have better news next month.